Shutting down a sole proprietorship can be a daunting task. Whether moving on to new ventures or simply closing up shop, understanding the tax implications of closing a sole proprietorship can save you time, money, and headaches. This article will walk you through everything you need to know to make this transition smoothly while optimizing your tax outcomes.

Table of Contents

What is a Sole Proprietorship?

A sole proprietorship is the simplest form of business structure, owned and operated by one person. While it offers ease of setup and complete control, it also means the owner is personally liable for all business debts and obligations. Shutting down a sole proprietorship involves several tax implications that you’ll need to address.

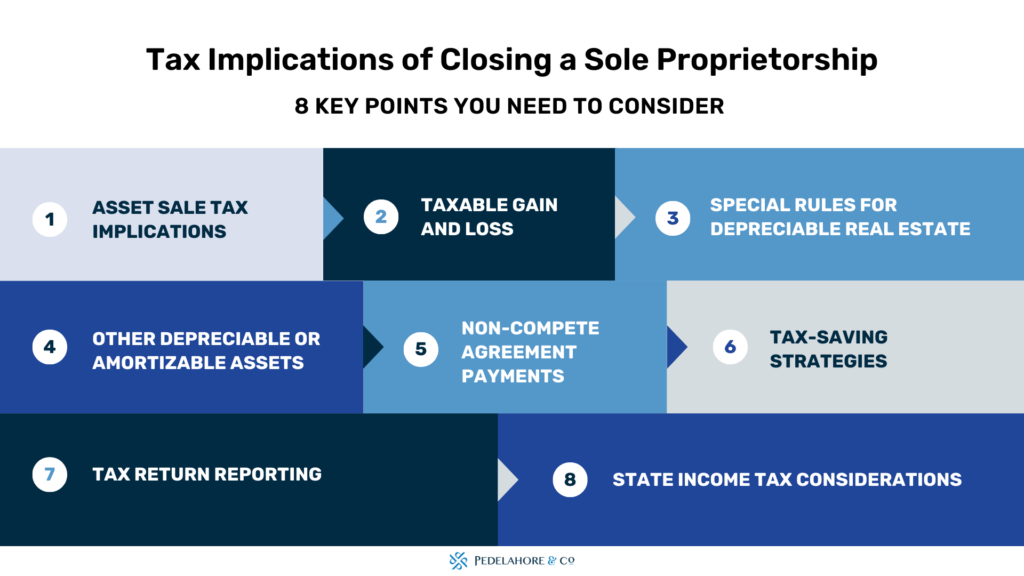

Why Understanding Tax Implications is Crucial: 8 Key Points

Failing to properly manage the tax aspects of closing your sole proprietorship can lead to legal issues, financial penalties, and undue stress. By understanding these implications, you can make informed decisions to minimize your tax liability and ensure compliance with federal and state regulations.

1 – Asset Sale Tax Implications

When shutting down a sole proprietorship, you essentially sell its assets rather than the business itself. Federal tax rules dictate how to allocate the total sale price to specific business assets. This allocation is critical as it impacts the calculation of taxable gain and loss.

How to Allocate Sale Price

You’ll need to assign a portion of the sale price to each asset based on its fair market value. This process helps in determining the taxable gain or loss for each asset sold.

2 – Taxable Gain and Loss

Understanding the concepts of taxable gain and loss is essential for accurate tax reporting.

Calculating Taxable Gain

You have a taxable gain if the allocated sale price exceeds the asset’s tax basis (original cost plus improvements minus depreciation/amortization).

Calculating Deductible Loss

You incur a deductible loss if the tax basis exceeds the sale price of the asset. This loss can offset other gains, reducing your overall tax liability.

3 – Special Rules for Depreciable Real Estate

Selling depreciable real estate comes with its own set of federal income tax rules that you need to be aware of.

Section 1250 Ordinary Income Recapture

The portion of the gain attributable to “additional depreciation” is taxed at ordinary income rates.

Section 1231 Gains

Gains from the sale of real estate used in a trade or business are treated as long-term capital gains if they exceed any non-recaptured Section 1231 losses from the previous five years.

Unrecaptured Section 1250 Gain

This portion of the gain from the sale of real estate is taxed at a maximum rate of 25 percent.

4 – Other Depreciable or Amortizable Assets

Gains attributable to depreciation or amortization deductions are recaptured and taxed at higher ordinary income rates. Remaining gains on assets held for more than one year are taxed at lower long-term capital gains rates.

5 – Non-Compete Agreement Payments

If you receive payments under a non-compete agreement as part of the shutdown, these are treated as ordinary income but are not subject to self-employment tax.

6 – Tax-Saving Strategies

Strategic planning can help minimize your tax liability when shutting down your sole proprietorship.

Asset Allocation

Allocate more of the sale price to assets generating lower-taxed long-term capital gains and less to those generating higher-taxed ordinary income.

Retirement Contributions

Consider making last-minute contributions to your retirement accounts to reduce your taxable income.

Expense Deductions

Ensure all business expenses are accounted for and deducted before closing the books.

7 – Tax Return Reporting

Properly reporting gains and losses is crucial for compliance and optimizing your tax outcomes.

IRS Forms to Use

- Form 4797 for reporting gains and losses.

- Schedule D for capital gains and losses.

- Form 8594 for allocating the sale price.

- Form 8960 for calculating the net investment income tax, if applicable.

8 – State Income Tax Considerations

You may also owe state income tax on gains from the sale of your business. For example, businesses domiciled in Louisiana may be exempt from state income taxes on the gain if the business was owned for at least five years. Always check local regulations for specific rules and exemptions.

Importance of Accurate Record-Keeping

Maintaining accurate records is essential for both federal and state tax reporting. Proper documentation can help you substantiate your claims and avoid potential audits.

Professional Help When Closing a Sole Proprietorship

Consulting with a tax advisor can provide personalized guidance tailored to your specific situation. They can help you navigate complex tax laws and identify opportunities for tax savings. Connect with our Pedelahore experts today!

Final Thoughts: Tax Implications of Closing a Sole Proprietorship

Closing a sole proprietorship is a significant step that comes with various tax implications. Proper planning, accurate reporting, and strategic tax-saving measures can help you navigate this process smoothly. If you need further assistance, don’t hesitate to consult with our team of experts who can provide personalized guidance tailored to your needs.

Are you ready to take the next step? Book a call with one of our Pedelahore Accountants today to refine your strategy and optimize your tax outcomes. Let’s make this transition as seamless as possible!